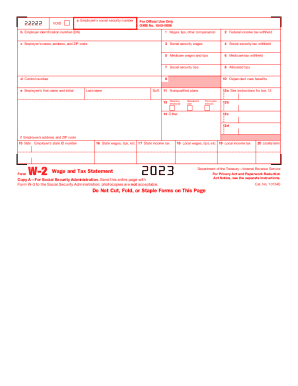

IRS 1099-NEC 2024-2025 free printable template

Instructions and Help about IRS 1099-NEC

How to edit IRS 1099-NEC

How to fill out IRS 1099-NEC

Latest updates to IRS 1099-NEC

All You Need to Know About IRS 1099-NEC

What is IRS 1099-NEC?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 1099-NEC

What should I do if I find an error on an already filed IRS 1099-NEC?

If you discover an error after filing the IRS 1099-NEC, you need to submit a corrected form. This can be done by marking the box on the original form that indicates that it's a corrected version and providing the accurate information.

How can I track the status of my IRS 1099-NEC filing?

To track your filed IRS 1099-NEC, you can contact the IRS directly or use an authorized e-filing service that provides tracking features. Keep the confirmation of submission as it may be required for verification.

What are the privacy considerations when filing IRS 1099-NEC?

When filing the IRS 1099-NEC, it’s crucial to ensure the privacy of sensitive information. Use secure methods for e-filing, and ensure that records are kept confidential according to data protection laws.

What if my IRS 1099-NEC is rejected during electronic filing?

If your IRS 1099-NEC is rejected, review the rejection code provided and make necessary corrections. Once corrected, re-submit the form promptly to avoid issues with compliance.

See what our users say