IRS 1099-NEC 2024-2025 free printable template

Show details

Attention:

Copy A of this form is provided for informational purposes only. Copy A appears in red,

similar to the official IRS form. The official printed version of Copy A of this IRS form is

scannable,

pdfFiller is not affiliated with IRS

Instructions and Help with form

How to edit

How to fill out

Instructions and Help with form

Have complete control of your tax forms with pdfFiller: easily fill out, edit, and share your form with relevant authorities without delays.

How to edit

Here are the steps on how to file 1099-NEC online with our online PDF editor:

01

Create an account. Sign up for a free pdfFiller account.

02

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail.

03

Edit form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file.

04

Save your file. Save your form in multiple formats, download it as a PDF, email it, or save it to the cloud. Alternatively, send 1099-NEC directly to the IRS.

How to fill out

Learn how to report 1099-NEC correctly:

01

Obtain a downloadable 1099-NEC form from the IRS website.

02

Fill out the payer's information, including name, address, and federal identification number.

03

Enter the recipient's information, including name, address, and social security number or taxpayer identification number.

04

Report the amount paid to the recipient in box 1.

05

Check box 2 if you made direct sales totaling $5,000 or more of consumer products to the recipient for resale.

06

If any federal income tax was withheld, report the amount in box 4.

07

If you withheld state income tax or are reporting state payments, check boxes 5-7.

08

File Copy A of form 1099-NEC with the IRS by the due date.

Show more

Show less

New updates of 1099-NEC

Purpose and Updates

Key Updates and Requirements

Specific Filing Instructions for 1099-NEC

Reportable Payments

Exemptions and Additional Notes

Corrections and Compliance

Corrections to Forms

Recipient Statements

New updates of 1099-NEC

The IRS Form 1099-NEC is essential for reporting nonemployee compensation, specifically for individuals or entities paid in the course of a business relationship outside of employment.

Purpose and Updates

Form 1099-NEC covers nonemployee compensation such as payments to independent contractors and certain types of sales. With updates in 2024, the IRS has lowered the e-filing threshold, requiring electronic filing for businesses submitting 10 or more forms.

Key Updates and Requirements

Form 1099-NEC must be filed by January 31, ensuring timely reporting for payments made in the previous year. The form requires accurate Taxpayer Identification Numbers (TINs) for each recipient. If a payee does not provide a valid TIN or if the TIN is incorrect, backup withholding rules apply, and the business must withhold tax from payments.

Specific Filing Instructions for 1099-NEC

Form 1099-NEC specifically targets income paid to nonemployees, focusing on payments related to business services provided by individuals or entities outside of an employer-employee relationship.

Reportable Payments

Form 1099-NEC requires reporting of payments of at least $600 made to nonemployees, including independent contractors, freelancers, and attorneys, with these payments recorded in Box 1. For sales of $5,000 or more on a buy-sell or deposit-commission basis, mark Box 2 to indicate significant transactions for resale purposes.

Exemptions and Additional Notes

Certain payments are exempt from reporting on Form 1099-NEC, including reimbursements for travel, costs for merchandise, and payments to tax-exempt organizations. Payments to corporations are also generally exempt unless they involve legal services, where reporting may still be required.

Corrections and Compliance

Making corrections to downloadable Form 1099-NEC is essential for compliance, especially if there are errors in the original filing.

Corrections to Forms

Corrections to Form 1099-NEC vary based on whether the form was submitted on paper or electronically. For paper corrections, do not check the VOID box, as this prevents the form from being processed by the IRS.

Recipient Statements

By January 31, businesses must furnish each nonemployee recipient with a statement detailing their reported income. TIN truncation is allowed on recipient copies to protect privacy, but the full TIN is required on IRS-submitted forms.

Show more

Show less

All You Need to Know About Tax Form 1099-NEC 2025

What is 1099-NEC?

What is the purpose of the 1099-NEC Tax Form?

Who needs?

Who is exempt from filling out the 1099-NEC income form in 2025?

Components of Form 1099-NEC tax form

Due date

1099-MISC vs 1099-NEC

What should be reported with the 1099-NEC tax form?

All You Need to Know About Tax Form 1099-NEC 2025

Learn everything you need to know about 1099-NEC: instructions, rules, and deadlines.

What is 1099-NEC?

Form 1099-NEC (Non-employee Compensation) is used by businesses to report payments made to non-employees, typically independent contractors, freelancers, and other service providers. It is essential for tax reporting, ensuring that both the IRS and the contractor properly account for income received outside traditional employment.

What is the purpose of the 1099-NEC Tax Form?

Form 1099-NEC is used to report non-employee compensation to the IRS. The form is required when businesses pay $600 or more during the year to individuals who are not employees for services performed, including payments for parts and materials. It also applies to payments to attorneys and specific sales arrangements. The form helps the IRS ensure that recipients of these payments report their income correctly. The form must also be filed if federal income tax was withheld under backup withholding rules.

Who needs?

01

Businesses that have paid at least $600 to a non-employee for services rendered during the tax year.

02

Self-employed individuals who have received at least $600 in non-employee compensation during the tax year.

Who is exempt from filling out the 1099-NEC income form in 2025?

Corporations: Payments made to corporations, including LLCs treated as C or S corporations, are generally exempt from 1099-NEC form reporting unless specific exceptions apply.

Merchandise and Similar Payments: Payments made for merchandise, freight, storage, and telephone services are not reportable on Form 1099-NEC.

Real Estate Agents or Property Managers: Rent payments made to real estate agents or property managers do not need to be reported on Form 1099-NEC, but agents may need to report payments to property owners on Form 1099-MISC.

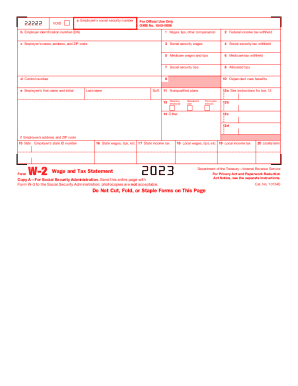

Employees: Payments to employees, such as wages, bonuses, or travel allowances, are reported on Form W-2, not on Form 1099-NEC.

Tax-Exempt Organizations: Payments made to tax-exempt entities, such as IRAs, HSAs, or government organizations, are exempt from Form 1099-NEC reporting.

Government Payments for Injuries or Wrongful Incarceration: Compensation paid by government agencies for injuries or wrongful incarceration is not reportable on Form 1099-NEC.

Credit Card or Third-Party Payments: Payments made via credit card or third-party networks (like PayPal) are reported on Form 1099-K by the payment settlement entity, not on Form 1099-NEC.

Scholarships and Fellowships: Scholarships or fellowships that are not taxable (unless linked to services like teaching) are not reported on Form 1099-NEC.

Informers' Fees Paid by Government: Payments made by government agencies or nonprofits for informers' services are exempt from Form 1099-NEC reporting.

Difficulty-of-Care Payments: Certain foster care providers receiving difficulty-of-care payments, which are excluded from taxable income, are exempt from 1099-NEC reporting unless they care for more than 10 children or 5 adults.

Debt Cancellation: Canceled debts are not reported on the 1099-NEC form, but on Form 1099-C.

Employee Business Expense Reimbursements: Payments for employee business expenses under an accountable plan are not reported on Form 1099-NEC, but non-accountable expenses are reported on Form W-2.

Components of Form 1099-NEC tax form

Payer’s Information

This section is about the business or individual paying for services.

Payer’s name: Enter your business or personal name.

Payer’s address: Include your business address (street, city, state, ZIP code).

Payer’s TIN: Enter your Employer Identification Number (EIN) or Social Security Number (SSN).

Recipient’s Information

This section pertains to the contractor receiving payments.

Recipient’s name: Input the contractor’s full legal name (as it appears on their Form W-9).

Recipient’s TIN: Include the contractor’s SSN or EIN, exactly as provided on their W-9.

Recipient’s address: Enter the contractor’s mailing address.

Nonemployee Compensation (Box 1)

In Box 1, input the total amount paid to the contractor for services during the tax year. This includes any commissions, fees, prizes, or awards paid to the non-employee, as long as the total exceeds $600.

Federal Income Tax Withheld (Box 4)

Box 4 is for reporting backup withholding (24% of the payment), which applies if the contractor fails to provide a valid TIN. If no withholding occurred, leave this box blank.

State Information (Boxes 5-7)

If your state requires reporting non-employee compensation for tax purposes:

Box 5: Enter the amount of non-employee compensation subject to state tax.

Box 6: Provide the state tax withheld (if any).

Box 7: Include the payer’s state identification number, if required by the state.

Due date

Form 1099-NEC must be sent to the IRS by January 31 for the previous year. If January 31 falls on a holiday or the weekend, the deadline extends to the following business day.

1099-MISC vs 1099-NEC

Before 2020, nonemployee compensation was reported on the 1099-MISC, but now it only covers miscellaneous income categories, while the 1099-NEC form handles service payments to nonemployees. Form 1099-MISC is still used for other purposes, but now, independent contractors have a separate form instead of Box 7 of the MISC-type report.

What should be reported with the 1099-NEC tax form?

Payments made to non-employees for services provided in the course of business must be reported as NEC on Form 1099-NEC. This includes payments to independent contractors, freelancers, or service providers, such as accountants, architects, and contractors, if the total paid during the year is $600 or more. Additionally, commissions to non-employee salespersons, fees for professional services, and payments to non-employee entertainers for services are also reported as NEC. Director’s fees and payments to insurance salespeople may also fall under this category, as well as certain golden parachute payments tied to changes in corporate control.

Show more

Show less

FAQ

What is nonemployee compensation?

These are payments for services provided for your trade or business by those who aren’t employees. Non-employee compensation can include fees, commissions, prizes, benefits, and awards for freelancers’ jobs.

Where can I get an IRS form 1099-NEC?

To order official IRS information returns, which include a scannable Copy A, visit www.IRS.gov/orderforms. Other fillable copies of the 1099-NEC are available in the pdfFiller form library. Click Get Form to start completing your report.

Can I share or create a 1099-NEC online?

You can submit Form 1099-NEC to the IRS by mail or online using the pdfFiller’s Submit to IRS feature. Check details with the Internal Revenue Service before filing the report.

How do I upload my tax forms to pdfFiller for editing?

Log in or sign up for a free pdfFiller account using your email, Google, or Facebook account. Go to your Dashboard, click Add New, and upload your form. Once your form is uploaded to our PDF editor, you are ready to start editing or filling your form.

Is pdfFiller a secure platform?

pdfFiller prioritizes your document security and uses advanced encryption technology to protect your information. Only you and the authorized recipients of your document have access to it. You can also password-protect your documents for an extra layer of security.

Can I access customer support in pdfFiller?

Should you have any questions, you can easily contact our support team 24/7 via online chat or form request. If you have a specific question about your document, you can send it directly to our team through your Dashboard. Click on your documents and choose Share with Support in the right menu.

What are key pdfFiller features?

pdfFiller offers flexible and user-friendly tools to have complete control of your document management process. With pdfFiller, you can edit PDFs, add electronic signatures, convert documents to different formats, and securely store your files in the cloud. It also has advanced features, such as automatic field recognition for forms and the ability to create fillable forms from scratch. You can also collaborate with others by sharing files and collecting digital signatures.

How do I share my completed tax forms directly from pdfFiller?

Once you complete your PDF and save your changes, you can easily share your tax forms with your accountant or tax advisor via email, shareable link, or fax. You may also select the option Send to IRS if you want to complete the process yourself.

Does converting documents impact their quality?

No, you can easily convert your forms from and to any format that pdfFiller supports. It is one of the most efficient ways to ensure your document's layout doesn’t change.

Can I manage fillable 1099-NEC directly from Gmail?

Yes, you can, with pdfFiller’s add-on for Gmail. Easily create, edit, fill out, and eSign your form 1099-NEC and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How do I edit the 1099-NEC form on my smartphone?

What if you don't file non-employee compensation on time?

If you fail to provide the right form to the right agency before the due date, you will be subject to penalties. The greater the delay in filing, the greater the penalty you will be assessed.

What's the difference between a Form W-2 and tax Form 1099-NEC?

You should use Form W-2 if you are an employee, as it reports wages, tips, and taxes withheld by your employer. If you provided services as an independent contractor or nonemployee, you will receive Form 1099-NEC, which reports payments of $600 or more for your services. The key difference is that Form W-2 is for employees, while Form 1099-NEC is for independent contractors or non-employees.

I received a 1099-NEC form instead of a Form W-2, but I'm not a business owner. How should I report this income?

If you received a 1099-NEC, the company considers you a self-employed worker or independent contractor, not an employee. You don't need a business to report your services on this form. If you're engaged in a trade or business and your goal is to make a profit, you'll need to report the income on Schedule C (Form 1040) and pay self-employment taxes if your net earnings exceed $400. If you're not self-employed, report the income on Schedule 1 (Form 1040). If you're unsure whether you're an employee or independent contractor, consult IRS publications for guidance.

See what our users say

Read user feedback and try pdfFiller to explore all its benefits for yourself

Easy to use and quick

Easy to use and quick. Two thumbs up!

This is making my job so much easier

This is making my job so much easier. thank you!

Try Risk Free